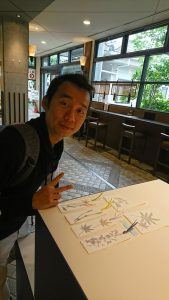

Last week of March was the best time to watch cherry blossoms in Fukuoka!

Here are comments from our students;

“The hanami activity was very refreshing and fun. After arriving at the station, we bought our bentos at a local store and walked to the park. As we talked under the shade of the cherry blossom trees, I felt like I grew closer with the NILS Teachers and my fellow students. When we walked around the park the many forms and sizes of the cheery tress left a deep impression on me. Every tree, every flower each had its own beauty. After taking many pictures of the trees, we returned to our picnic spot to continue talking and exchanging. Our talks continued as we returned to the station to break for the day.

Through this activity I was able to get to know everyone, which is important in communication, no matter what language is used. I used both my native tongue and my acquired Japanese to exchange my culture, history, experiences, and ideas with everyone. That is something that made me feel very happy and wish I was here for more than one week.”

“I enjoyed watching the cherry blossom with everyone. The cherry blossom viewing is a big event like a festival, which last for a few weeks, and a very relaxing to enjoy with people. In United States, there is cherry blossom, but there is not as many as in Japan. Also, the cherry blossom event in United States only last 2 weekends. The experience is very different between Japan and the United States.

My recommendation for everyone is staying in Japan to view the cherry blossom, which only happen once a year. “

“For this week’s activity we went to see the hanami, I was very excited because all my life I wished to see it. We went to Maisu Koen, which is a perfect place, because there are many sakura trees, canals and an observatory. We sat under a tree and ate an obento while we were talking and having a great time. After that, we walked around and took pictures of the beautiful landscape. I am very impressed of how the spring time arrived and suddenly all the nature changed. It was very interesting and funny. I want to do it again.”